Short Squeeze

|

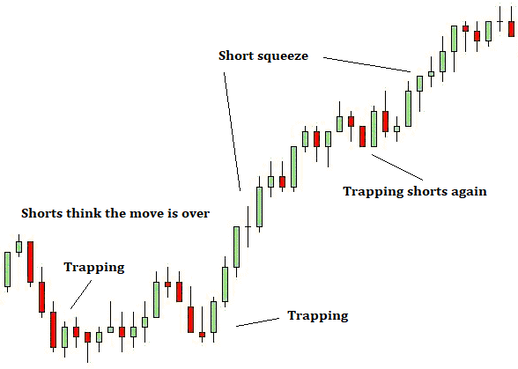

A short squeeze occurs when a stock is being driven up largely because shorts are buying to exit their positions (buying to cover).

When you short a stock you are first borrowing the stock and then selling it on the open market. When you look to exit the position, you are actually buying it back in order to cover the position. Short squeezes occur when there is a high short interest in a particular stock (maybe 20%) and as it pushes higher, the shorts are forced to frantically buy to take their loss. This buying can drive the stock much higher as it adds to the already existing buying to chase the move. This can be a great thing for someone in a long position as stocks can potentially explode when shorts are under a lot of pressure. In very low floats (stocks such as biotech), the squeezes can be massive. This is because the float of the stock is often very small (say 10 million shares) and it can move very quickly with little increase in demand. This fast upward movement can freak shorts out and cause big buying to exit out of fear. The float, short interest, and spread are three of the most important factors in the equation. High short interest with wide bid and ask spreads can cause crazy volatile activity that can scare both longs and shorts as they can be down big money very quickly. Nobody likes to see red on their screen. Another major factor is whether or not you are in a bull or bear market. Short squeezes are much more common when market confidence is high. In a fear based bear market it is much less likely to be the strong buying that can cause short pressure. Related to your trading: It can be extremely lucrative to anticipate a short squeeze and catch it long. Sometimes a stocks float is actually much lower than it appears because some big fish may have recently taken a position that has not yet been reported. A great example is the designed short squeeze that took place in a stock called AWX. Most of the float got bought up and so the actual float was much smaller than it was showing on websites like Finviz.com. Someone leaked the information and by the time the SEC form was released it had already exploded after hours. After market close in after hours trading short squeezes are common due to thin trading and therefore easy to manipulate. If you are going to short low float stocks understand that the volatility can have a major effect on your fear levels. You must be able to stomach the big volatility and price swings and a lot people cannot do this. Algo programs can be run and cause instant explosions with shorts trying desperately to cover. In my opinion, these programs should not even be legally allowed on stocks with floats under 20 mill. It always makes sense to have a hard stop in place to minimize the loss potential as these stocks can run hundreds of percent. |